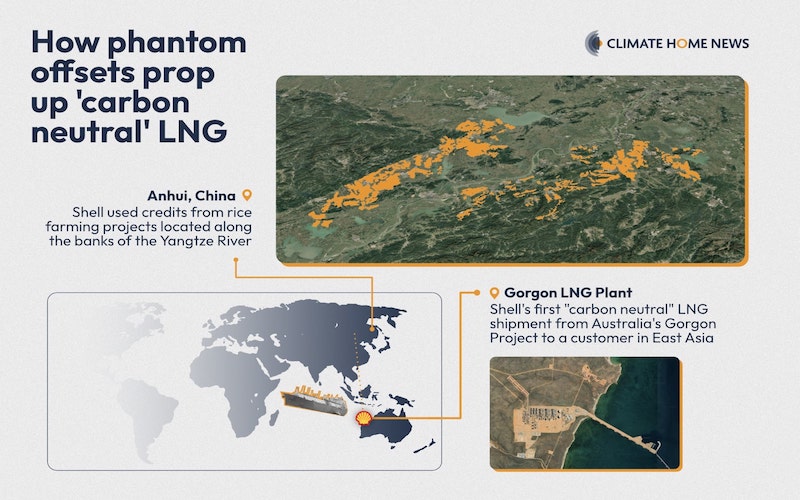

Since 2022, Shell has sold more than 20 cargoes of liquefied natural gas (LNG) as “carbon neutral” under a new industry-led standard. Climate Home News and Dialogue Earth can now reveal that this scheme has relied in part on “phantom” carbon credits that failed to cut emissions as claimed.

The energy giant shipped the fossil fuel to buyers in East Asia and beyond, some of whom in turn pitched the gas as a “net zero solution” to their customers thanks to Shell’s ‘green’ label.

Throughout its life-cycle – from extraction through transport and final use – LNG produces vast amounts of planet-heating carbon dioxide and methane emissions. But, using nearly 5 million carbon credits, Shell claimed to have cancelled out – on paper – the total carbon footprint of at least 23 of its LNG shipments delivered up to the end of 2023.

The projects propping up the oil and gas giant’s “carbon neutral” marketing drive included six that claimed to slash releases of methane gas from rice paddies across eastern China.

The emissions – purportedly avoided by introducing an improved crop irrigation method in the region – were meant to offset an equivalent amount of greenhouse gases caused by Shell’s LNG operations.

But earlier this year it became clear that the rice cultivation projects had not delivered the promised climate benefits. Leading carbon credit registry Verra axed them – along with 31 other similar schemes – in August after finding a string of failures in their implementation.

Now, new evidence gathered by Climate Home and Dialogue Earth casts serious doubt on whether any emissions-cutting activities were carried out on the ground at all.

Chinese local authorities meant to have played a crucial role in the schemes either denied their involvement or said no such efforts had taken place, according to statements made in response to disclosure requests submitted by a risk analysis firm and seen by Climate Home.

In addition, Dialogue Earth interviewed three rice farmers based in some of the project areas in China who said they had never heard of the carbon offset programmes and contradicted the project developers’ claims that new irrigation techniques had been rolled out there.

Recurring scandals

The findings raise questions about Verra’s broader ability to verify claims made by offset developers and to ensure the integrity of the thousands of projects issuing carbon credits on its platform, especially as the registry cuts back its workforce.

Jonathan Crook, a policy expert at Carbon Market Watch, an independent research group, said the “recurrence of such scandals in the market point to systemic and persistent issues”.

“Clearly there’s a major problem when projects actively manipulate data, which a supposedly rigorous audit process fails to detect, thereby erroneously generating millions of phantom credits for Shell to greenwash its LNG,” he told Climate Home.

A spokesperson for Verra said it had taken “decisive action at every level at which concerns were identified” with the rice farming projects. “Verra is committed to continual improvement, particularly as we address issues arising from inappropriate conduct,” they added.

Shell did not answer specific questions about Climate Home and Dialogue Earth’s findings in China, nor about its use of the suspect credits to deliver “carbon neutral” LNG. “We carefully source and screen the credits we purchase and retire from the market,” a spokesperson said, commenting more generally. “We’ve always been clear that carbon credits should have a verifiable carbon benefit and also deliver positive ecosystem and community impacts.”

Plan to curb methane from paddies

China’s eastern province of Anhui, a network of plains and hills traversed by the Yangtze River, is one of the country’s main rice-producing areas. Growing paddy crops provides a vital income for local farmers and strengthens the country’s food security.

But rice cultivation also has a significant negative impact on the climate. The flooding of paddies during growing seasons encourages the formation of bacteria. As the microbes feed on the organic matter abundant in the fields, they emit vast quantities of methane – a potent greenhouse gas.

To combat this problem, scientists came up with a relatively simple solution capable of cutting emissions by up to a half: instead of keeping the paddies flooded at all times, farmers could drain the fields periodically and, as a result, curtail the methane-releasing activity of the bacteria.

Farmers till rice fields and transplant rice seedlings in Anqing city, Anhui province, China, June 4, 2023. (Photo by CFOTO/Sipa USA)

In 2017, a Chinese agricultural technology company called Hefei Luyu launched a venture to roll out this climate-friendly irrigation method across Anhui province. It partnered with Shanghai-based consultancy Libra (now known as Search CO2), an early pioneer of China’s carbon market, and together they devised a plan to sell carbon credits from at least 10 rice cultivation projects.

Starting in late 2021, Shell got involved and gained what was described as “full agency” over the projects, becoming a broker of the credits generated by the activities after striking a series of deals with the developers.

Climate Home first revealed Shell’s role in the rice farming schemes in March 2023, alongside their risk of generating worthless offsets due to integrity problems such as over-counting emissions reductions and questionable practices used in their development.

Farmers deny involvement

One of the projects is located in the city of Tongcheng, where farmers were informed of the benefits of intermittent flooding and of the carbon credit scheme funding the innovation, according to documents submitted by Libra in 2021 when the developers registered the projects with Verra. Over 16,000 local farmers signed up to the scheme, Libra said.

But one farmer based in the project area told Dialogue Earth he had never heard of the carbon credit programme. He said local authorities did promote intermittent paddy flooding, alongside the rollout of a drought-resistant strain of rice, but the aim was simply to cope with limited access to water.

”No one mentioned emissions reduction or trading ever,” the farmer said, adding that the new method had not caught on widely in the area because of the lower rice yields it produces. Climate Home and Dialogue Earth granted anonymity to the farmers interviewed for this story due to the sensitive nature of the topic.

Experts quit carbon market watchdog in row over quality label for forest credits

In addition, the developers of the carbon credit scheme said cement ditches and reservoirs needed for the new irrigation method had been built in Tongcheng by early 2018, when the carbon crediting period started. But the farmer told Dialogue Earth that was not the case and the government hardened the channels only five years later, in 2023.

In nearby Yatan Town, which falls under a separate project linked to Shell, a different farmer said his village still uses traditional mud channels, despite the project documents claiming cement ditches were in operation there since 2017.

Government rejects developers’ claims

In all the project areas, developers including Hefei Luyu said they worked closely with local government bodies to sign up farmers to the initiative, provide training on the new irrigation technique and build key infrastructure, among other things.

Agricultural bureaus – an influential part of China’s state machinery – acted as the “main manager” in the construction phase of the different projects, according to near-identical documents submitted by Libra for the schemes.

But, when local authorities were asked about their involvement, a very different picture emerged. Ecoptima, an AI-driven risk intelligence agency, contacted more than 70 government authorities across China after its data analysis identified anomalies with the projects.

In written responses obtained by Ecoptima and seen by Climate Home, some local government agencies denied their involvement in the rice cultivation projects registered with Verra, while others said they had no knowledge of them.

Tongcheng’s Bureau of Agriculture and Rural Affairs said in July 2024 that it was “not currently included in this project, nor had authorisation been granted for the development of related enterprises”. It added that it held no records about the scheme.

The agricultural office for Wangjiang County, which has jurisdiction over Yatan Town, said it had “not carried out carbon reduction and measurement work related to rice production, and [had] not authorised enterprises to develop” any project.

Verra imposes sanctions

The evidence gathered by Climate Home and Dialogue Earth contrasts not only with the information supplied to Verra by the project developers, but also with assessments made by auditors responsible for verifying that the information provided is true and in compliance with the carbon standard’s rules.

Four auditing firms greenlit a total of 37 rice cultivation projects – including the Shell-linked ones – through to February 2023, when Verra suspended the schemes and started a review after becoming aware of concerns with how the rules were being applied.

More than 200 additional Chinese rice farming projects had also sought registration with Verra, but had not completed the process before Verra took action on those that had already been approved.

A farmer works on transplanting rice seedlings following days of heavy rainfall in China. REUTERS/Tingshu Wang

A Verra spokesperson told Climate Home that its subsequent 17-month investigation had brought to light an “unprecedented situation”. The carbon standard identified a long string of “serious issues”, including concerns about the accuracy of the baseline used to calculate emissions reductions and about the project activities claimed to have been implemented.

Verra also found weaknesses in the audits of the projects, with the companies that carried them out unable to fully explain how they had verified “independently and objectively” the credibility of the information provided by the project proponents.

The failures were so grave that, at the end of August this year, Verra revoked all the rice cultivation projects and announced “significant sanctions” against the project developers and the auditing firms involved.

The Verra spokesperson told Climate Home that if the auditors do not put “sufficient plans in place to prevent recurrence of these issues”, it may suspend them from conducting audits of other projects.

“Flawed” carbon market

Commenting on the case, Chauncey Wang, co-founder of Ecoptima, said it exposes “critical weaknesses” in the current system and pointed to the failure of auditors as “symptomatic of a deeper, persistent market flaw”.

“We’ve placed our trust in supposedly independent parties only to find that true independence is elusive in this market,” he told Climate Home.

Wang added that Ecoptima’s investigation into the rice projects revealed implementation challenges that could have been addressed through early detection.

Verra axing of Shell’s rice-farming carbon credits in China fuels integrity fears

Lambert Schneider, research coordinator for international climate policy at Germany’s Oeko-Institut, said the “limited oversight” of auditors is a “key concern” in the voluntary carbon market. Verification bodies are currently hired and paid directly by the project developers.

“Naturally, auditors do not want to lose their clients and this creates a conflict of interest,” Schneider told Climate Home. To tackle this, he suggested that carbon standards could themselves hire the auditors and the costs could be covered by project developers through carbon credit registration and issuance fees.

Greenwashing Shell’s emissions

By the time Verra cancelled the Chinese rice projects, more than 1.6 million credits generated by the projects had been used to offset the equivalent of the annual CO2 emissions of four gas-powered plants, according to a calculator provided by the US Environmental Protection Agency.

Shell emerged as the largest single user of the credits. In January, while Verra’s investigation was ongoing, the oil and gas major quietly retired over a million credits issued by the troubled projects. A carbon credit is retired when its owner declares that it has been used to mitigate emissions.

At least half of those retired credits helped prop up the company’s “carbon neutral” LNG campaign, according to a document published in June by Shell, which stated that the carbon credits “represent genuine and additional GHG [greenhouse gas] emissions reductions”.

Laurie van der Burg, global public finance manager for advocacy group Oil Change International, said it is “misleading” to claim LNG activities are “carbon neutral” by using carbon offsets. “It is simply an act of greenwashing,” she added.

President Biden sets US emissions goal for 2035 in the shadow of Trump

Other users of the phantom rice farming credits include Chinese state-owned fossil fuel firm PetroChina, Singapore-based DBS Bank and UK energy supplier OVO Energy.

A spokesperson for Verra said it had requested “full compensation” from developers for “all issued credits” from the revoked projects. Some compensation has already been “completed”, they added, without giving further details.

In response to a request for comment from Climate Home, Shell repeated a statement it first made in August, which said the company was “disappointed to learn of the issues Verra identified with these projects during their recent review” and indicated it would “continue to work closely with Verra to understand the impact of their findings”.

Industry ‘can’t be trusted’

Shell was not simply a final user of the sham credits but also had a direct stake in the projects. Starting in late 2021, the firm took on the role of “authorised representative” for the 10 schemes in Anhui, meaning it acquired all “applicable rights and responsibilities” equivalent to those of the project proponent, according to contracts seen by Climate Home.

But, in mid-October this year, nearly two months after Verra’s decision to cancel the credits, Chinese agritech firm Hefei Luyu sent a letter to the carbon standard notifying it of the “termination” of Shell’s role in the projects.

Shell has publicly signalled a broader intention to pull back from its direct involvement in carbon credit projects. Bloomberg reported last month that the company is looking to sell the majority of its carbon offsets business.

Failure of Busan talks exposes fossil fuel barrier to UN plastics pact

Experts told Climate Home this latest scandal further undermined the carbon market’s credibility as a way of offsetting still-rising emissions from the extraction and consumption of fossil fuels.

Van der Burg of Oil Change said Shell had been caught out using “what in essence are fake carbon offsets” as “dangerous escape hatches” to justify the growth of its LNG business.

“This is yet another example showing that we really cannot trust the industry to make sure that those carbon credits are actually reducing emissions, and, instead, we should force them to address their pollution at source, by curtailing their fossil fuel production and sales,” she added.

This story was published in partnership with Dialogue Earth. Additional reporting was done by Shi Yi and Yuhan Niu.

(Reporting by Matteo Civillini; editing by Sebastián Rodríguez and Megan Rowling)